Why Are Investors Dumping Gold? Another Victim Of A Strong U.S. Dollar

Gold rises as a safe haven when investors fear a recession, inflation increases or the U.S. dollar plummets, making the precious metal cheaper for foreign investors.

Well, none of these things are happening right now. Indeed, quite the opposite is happening. Gold prices fell to their lowest level in nine months. What's driving gold's decline?

Gold prices hit a nine-month low. Source: MetalMiner analysis of @stockcharts.com data.

The Case For A Bull Stock Market

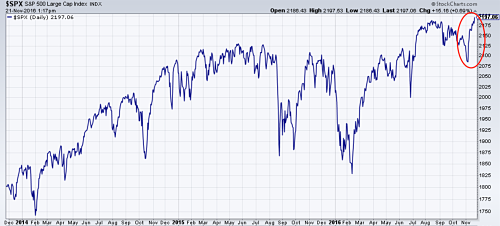

To be honest, I've been pretty skeptical of the U.S. stock market. Market indexes have traded sideways for almost two years. Still, they have avoided a severe bear market. The day Donald Trump was elected, markets opened sharply lower as fear consumed traders. But stock markets love to do the unexpected and indexes are now back to trading in record territory.

The S&P 500 surges following the Trump victory. Source: MetalMiner analysis of @stockcharts.com data.

Such action is a hint that equity trading desks and large funds aren't finished buying stocks yet. The question is: will Donald Trump's presidency for the next four years be just what the doctor prescribed to keep this aging bull stock market going, even after seven-plus years of gains behind its back? Could the rise in equities even accelerate?

That's too big of a guess. However, going back in history we noticed that in 1982, the stock market was on what it looked like the cusp of a major bull market. But soon after, the new president - Ronald Reagan - slashed taxes and unleashed a super bull market that lasted until the year 2000.

Not saying that history will precisely repeat itself, but the investing crowd is already making some strong bets even before Trump becomes president in January. So far, that hasn't helped gold as a safe haven.

The US Dollar Hits a 13-year High

Perhaps, the biggest factor driving gold prices south is a surging dollar.

The US dollar Index rises to its highest levels in 13 years. Source: MetalMiner analysis of @stockcharts.com data.

The U.S. Dollar Index, which tracks the performance of the dollar against a basket of currencies, continues to rise following President-Elect Donald Trump's victory.

Investors expect Trump's proposals to boost fiscal spending, cut taxes and loosen regulation. They also believe he will accelerate economic growth and boost inflation, bolstering the case for the Federal Reserve to raise U.S. interest rates. Expectations for an interest-rate hike in December's meeting have risen to more than 90%, up from 30% at the beginning of the month. Higher rates make the currency more attractive for yield-seeking investors.

A rising dollar depresses commodity prices, especially precious metals. It does have less of an effect on more economically-sensitive groups like energy and industrial metals. Indeed, industrial metals are on the rise despite a strong dollar. This is because the dollar is rising on expectations of higher rates down the road but, at the same time, metal prices are getting an additional boost because of Trump's plans to spend big on the nation's infrastructure. However, gold's demand won't be affected by infrastructure spending. As a result, investors are left without reasons to buy gold at this moment.